Is one of your New Year’s Resolutions to save more money? Or be wiser with money? I know mine is. I’m a massive shopaholic and until I started working, I was really bad with money! One of my resolutions this year is to not spend so unnecessarily and overindulge too much and save for things I genuinely need and want to achieve! I’ve realised that spending money on things like fantastic holidays is just so much more worthwhile.

As well as saving monthly anyway, I’ve decided that I want to start a money challenge to help me spend much more wisely, or better yet limit my spending and instead put what I would have spent on ‘other’ things to one side.

Ever heard of the 30-day squat challenge? The money challenge follows the exact same concept. There are 3 different challenges that are aimed at helping you to get into the habit of saving (if you are really bad at it). They are designed to get you going with saving money and also encourage you to think about what you are spending your money on. It’s also a commitment and tick box exercise so will give you some satisfaction when you complete it.

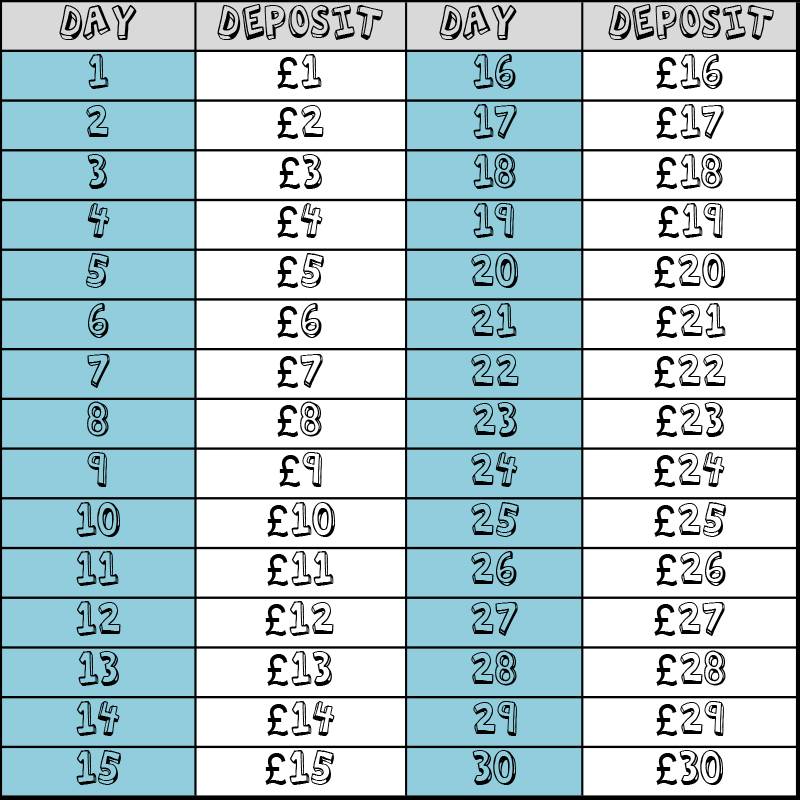

1. The 30 day challenge – With this challenge you are saving £465 in 30 days and £5,580 in a year. If you’ve never really saved much before, this will seem like a lot! This challenge is really simple, you are just adding one extra pound a day from the previous day, each day. It may seem like a struggle towards the end of the month but add the last weeks worth together, and thats probably what you may have spent on a shopping spree.

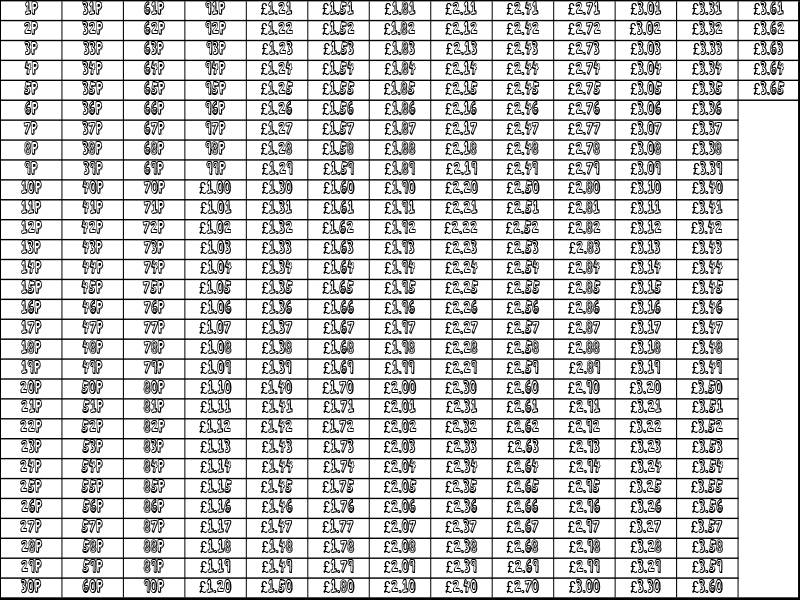

2. The 365 day challenge – In this challenge you are saving £667.95 in a year. It may not be that much, but it is by far the easiest challenge to get you into the habit of saving. Surely you can saving 1p on the first day!

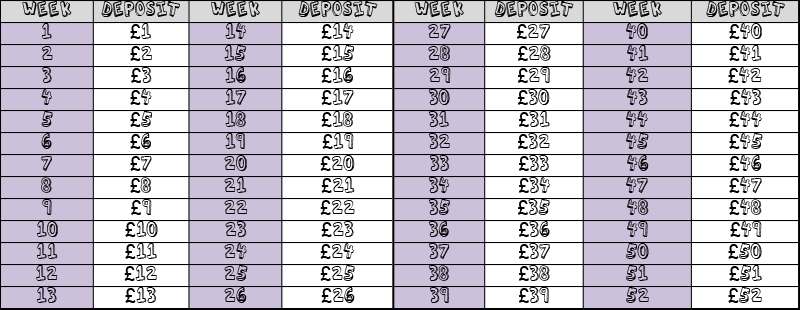

3. The 52 week challenge – With the 52 week challenge you will save £1,378 in a year, with saving the amount of pounds with the corresponding week number. I like this one, because it is a weekly saving so it doesn’t feel like you are giving up loads by the end of the year. This one however, gets a bit heavy towards Christmas time so involves some organisation of your funds.

Just a heads up, if you do all three in one year, you’ve saved £7,625.95. Which ain’t bad if you’ve never really saved before! Some might feel like its quite excessive by the end of it, and in the run up to Christmas can be quite challenging. So why not try it backwards? Or choose an order that suits you which still gets you to the same endpoint. Some people think it takes ages to see any real savings doing it this way, but the point is that they are savings, and you shouldn’t really be spending it! Good luck with your resolutions for 2016!

I’ll leave you with a good quote my sister found…

‘You gotta find the balance between having fun and having funds. Sometimes you gotta miss out to stack up.’

Love Nimisha

xoxo